The Basics of Forex Trading

Forex trading gives you access to trading currency pairs on the global market around the clock, making this investing potentially profitable if your decisions are informed and you effectively manage risk. Have the Best information about forex robot.

Trading can benefit from using leverage or borrowing money to boost their potential profits. However, trading with borrowed capital entails significant risks to your capital.

What Is Forex Trading?

Foreign Exchange Trading involves buying and selling currencies on the global foreign exchange market. It operates 24 hours per day, five days per week, with participants such as governments and central banks, commercial banks, financial institutions, investors, and traders all trading currency pairs on it.

Currency traders seek to profit by anticipating future exchange rate changes, similar to how stock investors attempt to profit from rising and falling stock prices. Forex trading takes place on the spot market, where traders trade pairs in real-time according to supply and demand conditions.

Forward contracts offer traders another means of trading currencies at specified dates in the future.

Forex trading is generally carried out by large institutional traders such as banks, investment funds, and multinational corporations to protect against operating risks associated with operating abroad. This is done by betting against currency exchange rate fluctuations and making speculations against fluctuations. Individual traders can also participate in forex by using leverage.

Currency Exchange

Daily trillions are changing hands in global currency markets. These markets are highly professional, operating 24 hours a day thanks to international cooperation among bank traders. At the close of trading day in Asia, bank traders pass open positions onto traders in Europe, who pass them onto those in America; this process continues across borders – creating what is known as an interbank market as well as being the primary source of foreign exchange.

Leading participants in this market include central banks, financial institutions, and multinational corporations; however, anyone converting currency (such as travelers going abroad) takes part as well. Currency demand is determined by multiple factors such as speculation to economic growth and political stability of issuing countries; the market also sets spot exchange rates as well as forward rates that will go into effect at some future date. Currency exchanges make money through charging fees as well as through their bid-ask spread in any given currency pair.

Margin

Trading on margin can increase your return potential and provide greater purchasing power, but it also comes with higher risks. Be sure to understand and can afford the potential losses.

Margin is the percentage of the total value of your trade that your broker sets aside from your account balance to manage it. It provides traders with leverage that allows them to open more prominent positions with a smaller initial capital outlay. As with all forms of leverage, though, margin magnifies both your profits and losses.

As soon as your account falls below its maintenance margin level, a margin call will notify you. It won’t come in the form of a phone call; instead, an email or popup in your trading platform will alert you that it has reached or near minimum margin requirements. If adjustments aren’t made promptly, a broker may liquidate a portion of your position or close your trade unless appropriate adjustments are made quickly enough – that’s why keeping tabs on margin levels is so essential if you want to continue opening trades without interruption from brokers!

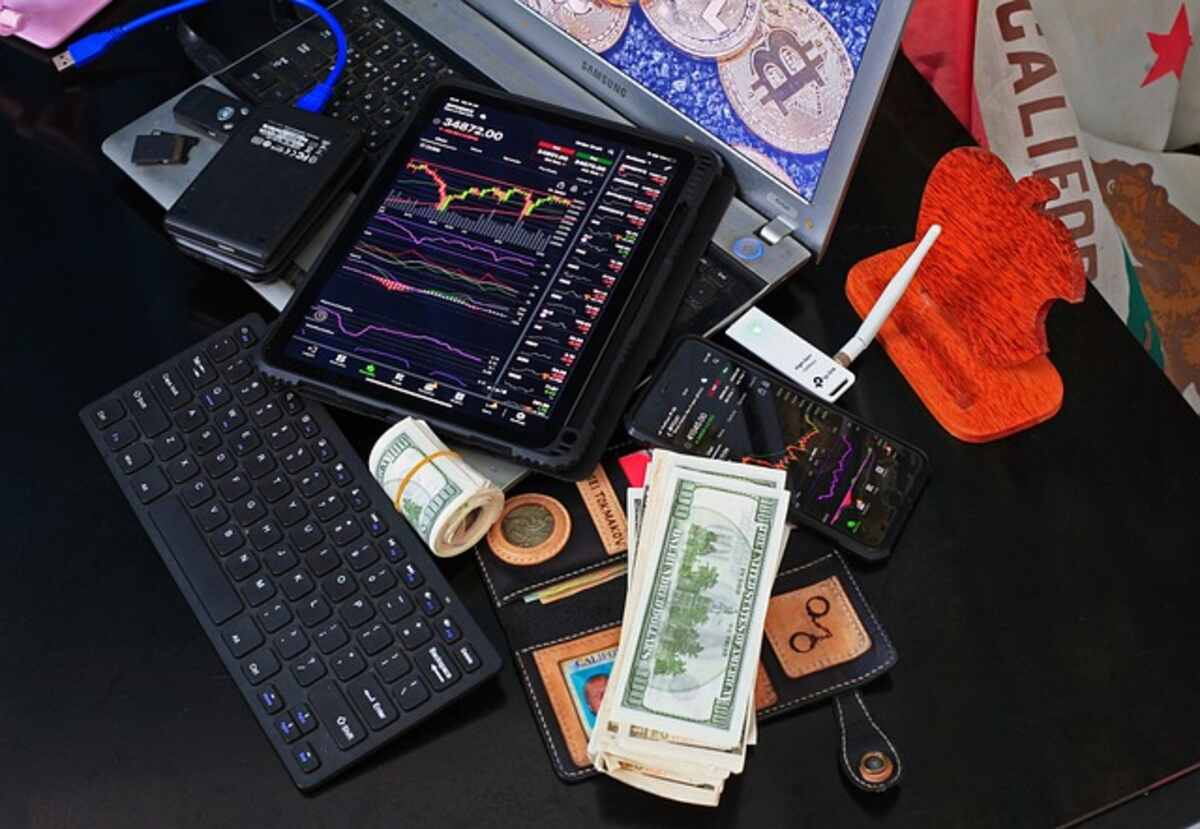

Trading Platforms

Forex trading platforms connect traders to global capital markets and offer a range of features designed to support market research, trading, and management activities. The most reliable platforms adhere to stringent regulatory standards that protect traders against unethical practices while protecting funds securely.

Considerations when selecting a trading platform should include fees, minimum account size, and customer support services. Many forex brokers provide demo accounts so potential traders can test out their platform before making deposits.

Desktop trading platforms are installed as software on traders’ computers and provide the most comprehensive array of features. Web-based platforms, meanwhile, can be accessed via any Internet browser, allowing traders to trade from any location with Internet connectivity. Mobile trading platforms for Android or iOS mobile phones enable traders to trade while on the move. Some mobile trading platforms provide additional features like educational materials, market insights, and trading signals, which help traders make better decisions and offer flexibility of payment methods as well.

Trading Currencies

Simply put, forex trading involves purchasing one currency while selling another. For instance, if you believe the Euro will appreciate against the U.S. dollar, buying EUR/USD (euro/U.S. dollar) would be wise in your prediction; should your guess come true, your profit could increase substantially! Unlike stocks, which trade via an organized exchange system, currencies are bought and sold by global banks through a decentralized method.

Currencies are always traded in pairs, with the price on a forex pair representing how much one unit of one currency is worth in another currency. Currency values can also be affected by factors like interest rates, inflation, central bank policy, and economic growth rates. As with all forms of speculation, there are risks involved; forex traders can leverage themselves with leveraged transactions to increase returns; some brokers also provide CFDs that enable traders to speculate without actually owning assets (like stocks or commodities). IG provides both spot and future CFDs specifically tailored for forex trading, allowing traders to speculate without owning assets ( stocks or commodities). Some brokers also offer CFDs, which would enable traders to speculate without actually owning what could happen with exchange rate fluctuations – while some brokers provide CFDs to allow traders to speculate without owning either asset (like stocks or commodities); brokers offer futures contracts and spot CFDs specifically explicitly dedicated for trading forex.